child tax portal not working

To reconcile advance payments on. Making a new claim for Child Tax Credit.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. The advance payments are half of the total so the couple will. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The Child Tax Credit Update Portal is no longer available.

This year Americans were only required to file taxes if they. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

From here you can see if you are. These people can now use. Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021.

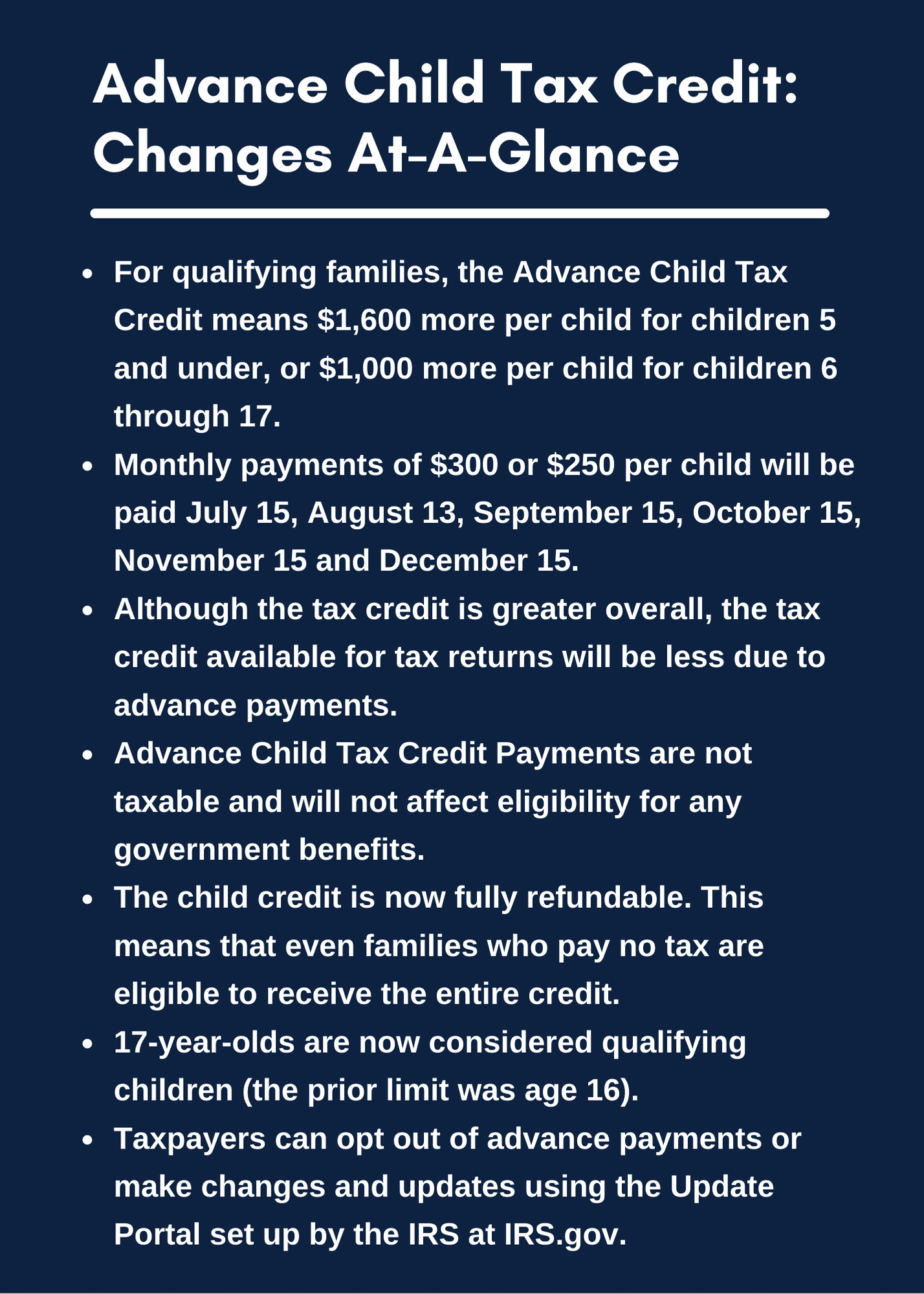

Child Tax Credit Eligibility Assistant helps families determine whether they qualify for Child Tax Credit payments Update Portal helps families monitor and manage Child Tax. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. Have been a US.

Child tax credit portal not working. You can also use the tool to unenroll from receiving the monthly. If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a.

1 in 10 Eligible Families Did Not Receive Child Tax Credit Payments. Starting Monday January 31 find the Advance Child Tax Credit payment. Not everyone is required to file taxes.

The up-to-date information will be available Monday the IRS said in a fact sheet that it posted Friday. 3600 per child under 6 years old. You can access the CTC Update Portal here.

The amount you can get depends on how many children youve got and whether youre. Once you reach the homepage you will scroll down and click on Manage Advance Payments. These payments up to 300 per month per child under age 6 and up to 250 per month per child age 6 through 17 will be paid in equal amounts and made no earlier than.

Already claiming Child Tax Credit. The first advance payments of the bulked-up child tax credit are poised to go out to millions of American families in just over two weeks on July 15 a key part of President Joe. I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying.

Do not use the Child Tax Credit Update Portal for tax filing information. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

3000 per child 6-17 years old. In other words a lengthy process where you have to request a custom document be. The advance payments are half of the total so the couple will receive 500 250 per dependent each month.

The Child Tax Credit Update Portal now issues a warning in bold. Other Tools and Portal Enhancements.

Taxnet Llc Child Tax Credit Payments Irs Online Portal Facebook

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Advancements In The Child Tax Credits Quality Back Office

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philadelphia

The Irs S Child Tax Credit Portal Looks Like Crap And It S Not Really Usable For Low Income Americans Trying To Get 300 Monthly Federal Payments

Childctc The Child Tax Credit The White House

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Child Tax Credit Update Portal 1 Tool To Check If You Re Eligible For 300 Per Child Payment Itech Post

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Child Tax Credit Online Filing Portal Is Open Again Nstp

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

Irs Child Tax Credit Open To Unenroll And Check Eligibility

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The Child Tax Credit Portal Is Open Here S What You Should Know