st louis county sales tax car

FRANKLIN COUNTY NEW HAVEN AMBULANCE DISTRICT. The St Louis County sales tax rate is.

Used Car Dealer In St Louis Mo 63136 Drivetime

The antique vehicle is classified as such if it was made more than 25.

. The minimum combined 2022 sales tax rate for St Louis County Missouri is. This table shows the total sales tax rates for all cities and towns in St. This is the total of state and county sales tax rates.

Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. The 2018 United States Supreme Court decision in South Dakota v. Louis County Assessor Jake Zimmerman warned taxpayers earlier this year to keep a close eye on the declarations because your car may be worth more than expected.

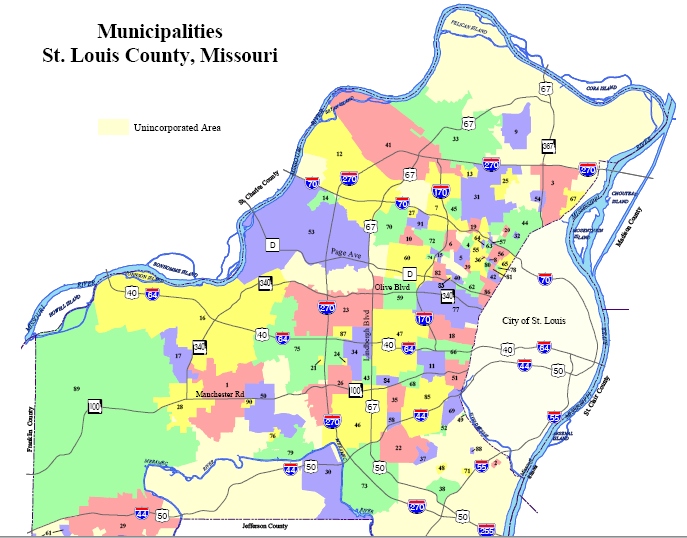

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. 4202022 TA0308 Updated 4202022. Monday - Friday 8AM - 430PM.

Home Motor Vehicle Sales Tax Calculator. The state sales tax for a vehicle purchase in Missouri is 4225 percent. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Their website states You must pay the state sales tax AND any local taxes of the city or county where you live not where you purchased the vehicleThe state sales tax rate is 4225 percent and is based on the net purchase price of your vehicle price after rebates and trade-ins. Louis MO 63103 Sales are held outside of the building on the 11th Street side. The December 2020 total local sales tax rate was also 7375.

Louis County Transit Use is line number 329 and the vehicle excise tax is line number 327. 12000 x 004225 12000 x 00454 50700 53448 104148. Purchasing Division 4787 Midway Road Duluth MN 218-726-2666 Email Resources.

Sales are held at 900 am sharp at. FRANKLIN COUNTY MERAMEC AMBULANCE DISTRICT ST CLAIR FIRE PROTECTION DISTRICT. The current total local sales tax rate in Saint Louis County MN is 7375.

The deadline for the. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. You pay tax on the sale price of the unit less any trade-in or rebate.

A county-wide sales tax rate of 2263 is. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Louis County where the combined cost is a whopping 11988. The current total local sales tax rate in Saint Louis County MO is 7738. To review the rules in Missouri visit our state-by-state guide.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. 41 South Central Clayton MO 63105. Missouri places a 423 sales tax on all car purchases.

Local sales tax is highest in St. The Missouri state sales tax rate is currently 423. Missouri Department of Revenue.

Motor Vehicle Sales Tax Rate Chart. 44 rows The St Louis County Sales Tax is 2263. Of course car buyers will find much more competitive fees outside the city.

The Missouri state sales tax rate is currently. Monday - Friday 8 AM - 500 PM NW Crossings South County. There is also a local tax of up to 45.

The most that can be charged. These records can include Randolph County property tax assessments and assessment challenges appraisals and income taxes. Reported on a separate line of your return.

A link to the list of properties will be posted on this page after the date of publication which is two weeks prior to the sale. Youll also have to pay a county sales tax ranging from 268 to 769. In addition to taxes car purchases in Missouri may be subject to other fees like registration title and plate fees.

Louis County Transit Sales is line number 328 St. Louis County Sales Tax is collected by the merchant on all qualifying sales made. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802. You do not pay any sales tax if the vehicle was given to you as a. Louis County transit use tax applies when you are located in the county and you buy items or services without paying the transit sales tax.

Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. The purchase of a vehicle is also subject to the same potential local taxes mentioned above. Complete Policy Manual of the St.

For additional information click on the links below. Sales Tax Institue explains that as of July 1 2019 antique cars are exempt from the Louisiana local and state vehicle taxes. Civil Courts Building 10 North Tucker Blvd 4th floor St.

The December 2020 total local sales tax rate was 7613. Has impacted many state nexus laws and sales. Sales tax in Saint Louis County Missouri is currently 761.

2020 rates included for use while preparing your income tax deduction. The Missouri DOR is the agency authorized to assess and collect the monies. The Collector of Revenue serves as the billing collecting and disbursing agent for more than 200 different taxing districts in St.

To arrive at this total multiply the sales price by the state tax rate of 4225 percent. The lowest combined rate is in Scotland. Then multiply the sales price by the local sales tax rate of 4454 percent and add the two figures for example.

To further accelerate investment and. Subtract these values if any from the sale. Motor vehicle titling and registration.

The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for title if the address of the applicant is within a city or county listed below.

Action Plan For Walking And Biking St Louis County Website

Ford Dealership Near St Louis Mo Bommarito Ford

Used Car Dealer In St Louis Mo 63125 Drivetime

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Collector Of Revenue St Louis County Website

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Sales Tax In Missouri Getjerry Com

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Missouri Vehicle Registration Of New Used Vehicles Faq

Online Payments And Forms St Louis County Website

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

New Hyundai Tucson For Sale In St Louis Mo

Shop Our North County St Louis Dealership Inventory Drivetime

Enterprise Car Sales Home Facebook

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

New Hyundai Palisade For Sale In St Louis Mo

Missouri Car Sales Tax Calculator

169 Used Cars For Sale St Louis Di Target City 1 Frank Leta Acura